A Reality Check Behind the Headlines

A weakening rupee often makes headlines with a familiar claim:

“Good news for exporters.”

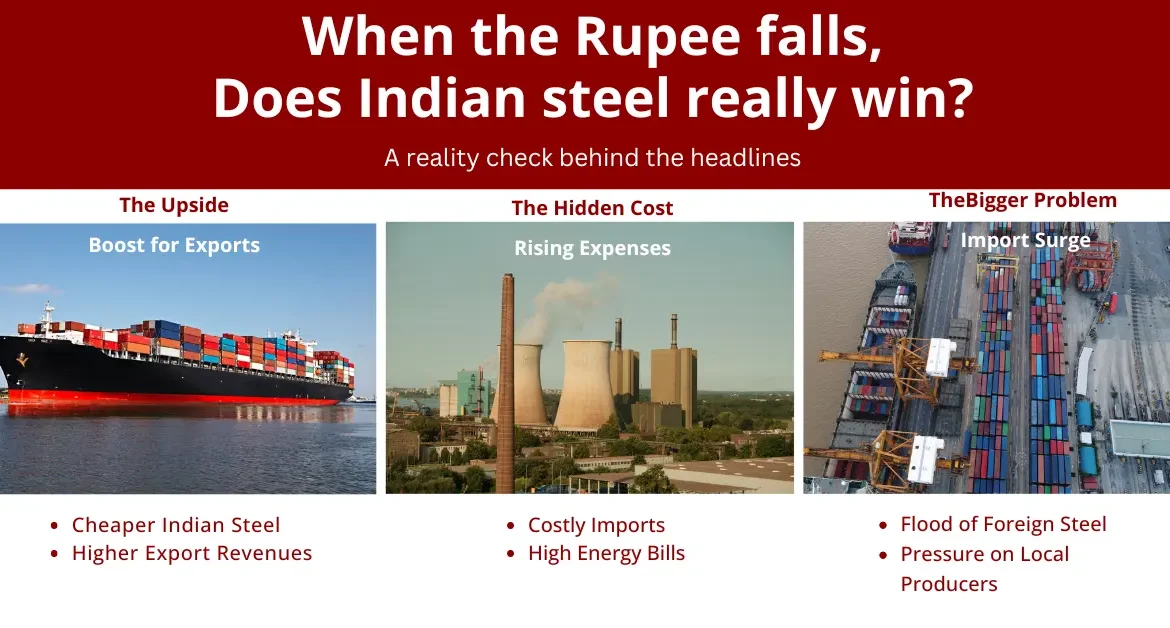

But when we closely examine the impact of weak rupee on Indian steel industry, the reality is far more nuanced. While a softer currency can open export opportunities, it can also quietly raise costs, squeeze margins, and deepen structural challenges across the steel value chain.

Let’s break down the impact of weak rupee on Indian steel industry in plain terms.

The Upside: Why a Weak Rupee Seems Good for Steel

When the rupee weakens against the dollar, the impact of weak rupee on Indian steel industry appears positive at first glance.

-

Indian steel becomes cheaper for global buyers

-

Overseas customers pay fewer dollars for the same tonne of steel

-

Indian exports become more competitive, especially in markets like the US and Middle East

Export revenues also translate into more rupees. This means steel companies earn higher rupee realizations for the same dollar invoice, which can support margins — if costs are controlled.

On paper, the impact of weak rupee on Indian steel industry looks like a clear win.

The Hidden Cost: Where the Advantage Gets Eroded

Steel is not just about selling; it is about what goes into making it. This is where the impact of weak rupee on Indian steel industry becomes more complex.

Steel manufacturing in India depends heavily on imported inputs, most of which are priced in dollars:

-

Coking coal

-

Energy (oil and gas)

-

Machinery and spare parts

When the rupee weakens, these inputs immediately become more expensive. As a result:

-

Production costs rise

-

Energy bills inflate

-

Capital equipment becomes costlier

For many producers, higher input costs cancel out the export currency benefit. In practical terms, the impact of weak rupee on Indian steel industry often balances itself out.

You earn more on exports, but you also spend more to produce them.

The Bigger Problem: Imports Flooding the Market

Another critical dimension of the impact of weak rupee on Indian steel industry is India’s steel trade balance.

Over the past few years:

-

India has increasingly become a net importer of finished steel

-

Cheaper steel from China, Japan, and South Korea has entered the domestic market

-

Global overcapacity, especially from China, has pushed international prices down

This has resulted in:

-

Pressure on domestic steel prices

-

Thinner margins for Indian producers

-

Reduced pricing power in the local market

Even strong domestic demand driven by infrastructure and construction has not fully protected manufacturers, as imports continue to fill the supply gap. This makes the impact of weak rupee on Indian steel industry even more challenging.

Why This Matters for India’s Economy

The impact of weak rupee on Indian steel industry extends beyond corporate balance sheets. It directly affects India’s broader economy and trade position.

When steel imports grow faster than exports:

-

The merchandise trade deficit widens

-

Pressure increases on the rupee

-

The cycle reinforces itself

This is why policymakers closely monitor the steel sector and evaluate tools such as:

-

Safeguard duties

-

Anti-dumping measures

-

Trade policy reviews

Managing the impact of weak rupee on Indian steel industry is therefore both an economic and policy priority.

The Real Takeaway

A weak rupee is not a silver bullet for Indian steel.

The impact of weak rupee on Indian steel industry is a double-edged sword:

-

Helpful for exports

-

Painful for input costs

-

Risky amid cheap imports and global overcapacity

For steel producers, long-term strength will depend less on currency movements and more on:

-

Cost efficiency

-

Supply chain resilience

-

Value-added products

-

Policy support and fair trade enforcement

Final Thought

Currency headlines are tempting.

But when analysing the impact of weak rupee on Indian steel industry, fundamentals matter far more than forex movements.

The real winners will be companies that balance global competitiveness with cost discipline — regardless of where the rupee moves next.

Author

N.M. Rajendhiran

(President – Steel and Coal Trading)